In cryptanalysis today we look at number one Cryptocurrency In the world: Bitcoin (BTC)† In this article we will discuss Bitcoin price Based on fundamental and technical analysis. We will first review recent developments to see what has been happening in the Bitcoin ecosystem over the past period. Of course, we also look at the Bitcoin price chart to study the recent price action. Additional technical analysis from our Bitcoin analysts can be found at Premium environment For Crypto Insiders!

Recent Bitcoin Developments

One of the latest developments in Bitcoin is that yesterday 19 million bitcoins been mined. This is an interesting fact, as only 21 million bitcoins will be mined. Once these 21 million bitcoins are in circulation, no additional bitcoins will be added. Although it looks like we’re approaching the finish line after about 12 years, nothing could be further from the truth. The last few bitcoins won’t be mined until 2140. The new influx of bitcoin is slowed down by the so-called Bitcoin Halving†

We also see an interesting pattern emerging between the number of active wallets and the volume of Bitcoin. There is a logical relationship between these two data. After all, the more active wallets there are, the higher the volume. However, a new peak in the number of active portfolios is observed every 6 to 8 days. These peaks are clearly reflected in the volume graph (purple graph). So most investors actively work with their bitcoins every 6 to 8 days.

Additionally, we also see the above peaks reflected in the chart below. The chart below shows the inflow and outflow of bitcoin to exchanges. This graph generally shows net flow; Almost every day, the number of bitcoins withdrawn from exchanges exceeds the amount deposited. This is of course a rising A sign, as this shows that investors want to hold their bitcoin for an extended period of time and have no intention of selling it.

Bitcoin technical analysis

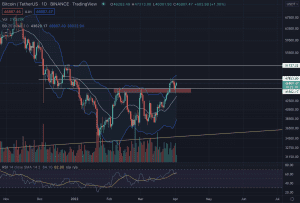

Bitcoin price has shown a lot of movement in recent weeks, but the break above the double top has been the highlight. The price recently struggled to break the $45,500 level, but eventually succeeded. In recent days, the price made a slight downward movement, but this move only ensured that the old resistance of $45,500 was tested as new support. For now, it looks like we can maintain that level. As long as the price does not drop below this again, we will remain bullish. The white lines on the chart below are the levels where bitcoin could still encounter strong resistance before the price really goes up. So times remain uncertain for Bitcoin.

How do I determine the right time to buy bitcoin?

Thinking of taking a position in BTC, but not sure when is the best time to get in? Ask an experienced analyst on our site Premium environment for members! Here, additional technical analyzes are shared daily by several analysts who delve deeper into the price. Here you can easily connect with several experienced crypto-analysts and trainers, who are happy to help you make an informed decision. You can now try this for free and without obligation for the first 30 days!

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Bitcoin price rises after new jobs data from US

European stock markets open higher | beursduivel.be

Russia’s oil imports to China decline