The US Federal Reserve began the most aggressive interest rate campaign in its history in March 2022. Despite these substantial interest rate increases, the US economy has managed to stay afloat and, against all expectations, has yet to hit a recession. As a result, Bitcoin and stocks are doing well right now.

But according to a more reliable indicator, we may still have to worry about a recession in 2024.

Another recession in America?

The effect we get now is the so-called inertial signal Inverse of the yield curve.

This is referred to as the interest rate on short-term US government bonds more rather than long-term variations. The graph below shows the interest rate on government bonds with 1-month maturity and 10-year maturity.

Generally, as an investor, the longer you lend your money, the higher the interest rate you will earn. The explanation for this is logical. You face more risk at various points over a 10-year term than a 1-month loan.

As you can see the result of each Reverse The yield curve since the recession of the US economy in 1964.

However, that recession came Reverse The interest rate on long-term government bonds reverted to a higher natural position than short-term government bonds.

That moment seems to be approaching, which is why the recession alarm bells are ringing alarmingly again.

What does this mean for the price of Bitcoin?

A recession will be a negative development for Bitcoin price in the short term. A recession usually means people lose their jobs, companies go bankrupt, and the economy gets into trouble.

Logically, for this reason less capital is available for investments and you often see people (selling their investments) to protect themselves against economic disaster.

That way, let's hope there is no recession.

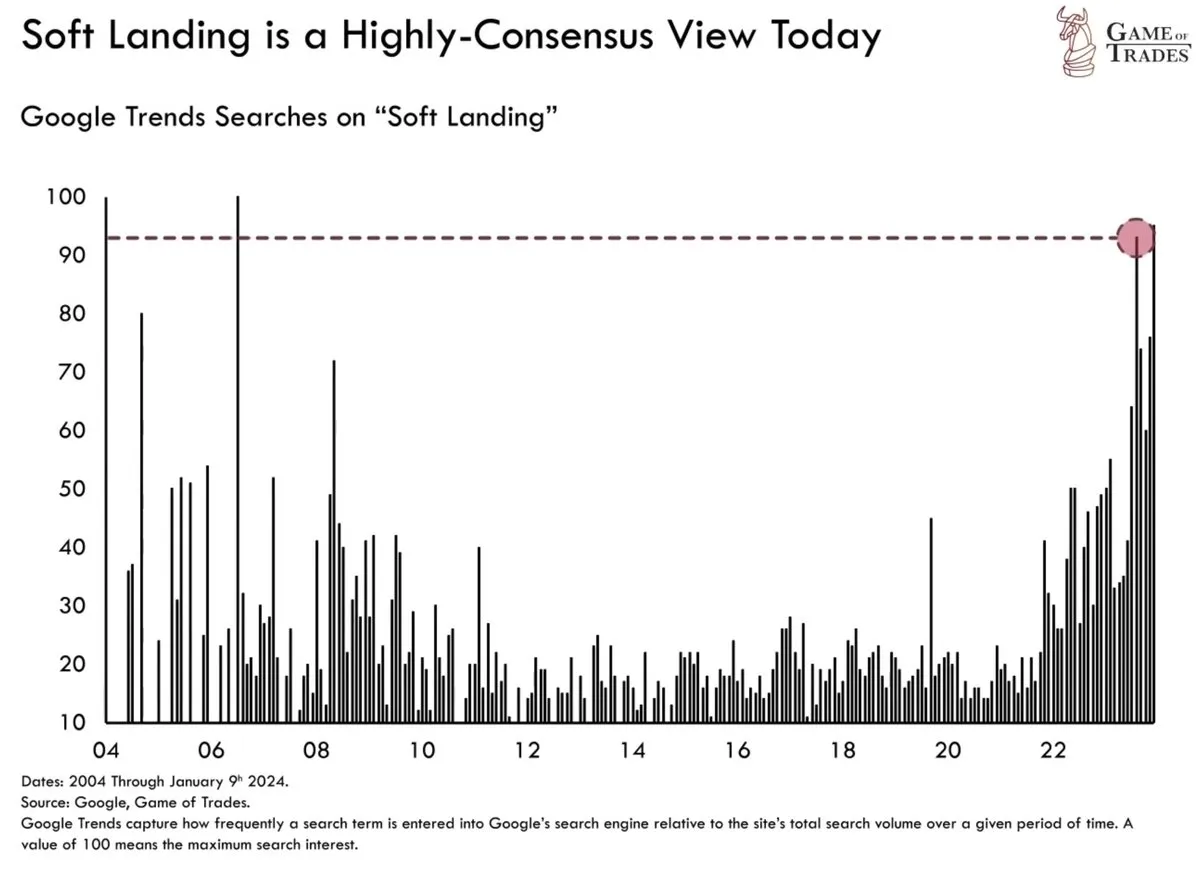

Even more so, almost everyone is now counting on a “soft landing” for the US economy. If inflation returns to the desired level of 2.0 percent, we are talking about a soft landing if the Fed succeeds in not triggering a recession.

That positive sentiment is also reflected in the price of Bitcoin as everyone is now expecting a soft landing. If we have a surprise slowdown, we will undoubtedly see this reflected in the price of Bitcoin.

Trade €10,000 for free and get a €20 bonus

Are you looking to enter the world of crypto and buy Bitcoin or another crypto? Grab your chance with this exclusive December offer! Thanks to a special agreement between Newsbit and Bitvavo, one of the most accessible and user-friendly crypto exchanges in Europe, our readers get an exclusive offer.

Only in the month of December: Register with Bitvao with the button below and get 20 euros absolutely free. And that's not all – you don't even pay trading fees on your first €10,000 in transactions. Register now!

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

From Concept to Creation: Designing Your Signature Acrylic Nails

How to Care for Your Marginated Tortoise Year-Round

Biden and Xi want to sit down one last time