You may have noticed, but right before bedtime last night, it was Bitcoin price very Difficult. First through the €40,000 limit and then beyond. What happened?

A causal relationship can never be established with complete certainty, and often several factors play a role. We look at two of them in this article.

US central bank rate hike

While we would like to see it differently, Bitcoin is closely related to the stock markets. At the end of last year, the 100-day correlation coefficient between Bitcoin and the S&P 500 was 0.33, one of the highest for 2021. A coefficient of 1 means that both origins are behaving like Ronald de Frank de Boer, while minus -1 is lagging. Seeing them move in opposite directions.

As such, the drop in last night’s price and this morning’s price may be associated with similar, but more moderate losses in the stock market. The Nasdaq has lost 3.3% over the past 24 hours, while the S&P 500 has lost 1.9% over the same period.

Those stock market losses are attributed to the US Federal Reserve. The Fed said it will start raising interest rates in the coming months. This in turn causes all kinds of different feelings about inflation.

It is believed that this rate hike may come as early as March at the earliest. Fear of such a big decision in such a short time frame may have made investors choose money for their eggs.

Unrest in Kazakhstan has led to a decline in Bitcoin’s computing power

Kazakhstan declared a nationwide state of emergency early this week as citizens protested the hike in fuel prices. This has since led to the resignation of the government.

From writes NOS– The resignation of the government and the measures taken by the President of the Republic after a turbulent night in which protests erupted over the prices of liquid gas until the early hours of this morning in various places. On New Year’s Day, the price of LPG suddenly increased from 50 to 60 Kazakhstani tenge (10 to 12 euro cents) to 120 tenge (24 euro cents) per liter. This led to great resentment among many Kazakhs, who often drive cars with LPG tanks.

As a result of the protests, the Kazakhstan government shut down the Internet, According to nu.nlAs a result, many bitcoin miners went out of business.

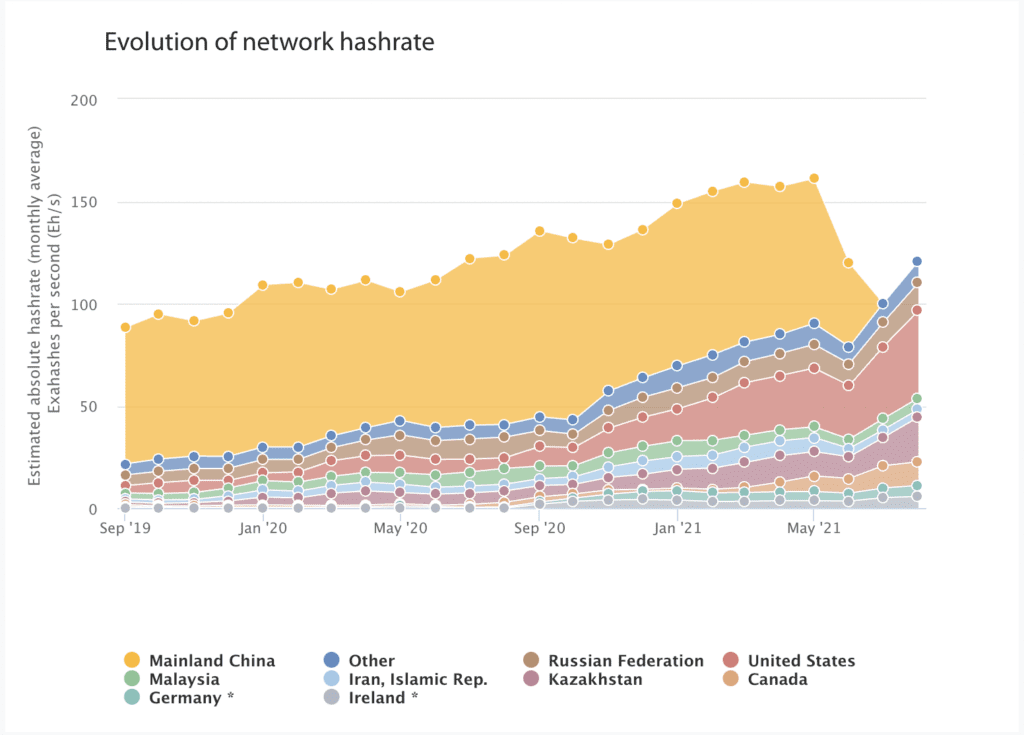

According to the University of Cambridge, Kazakhstan accounts for about 21.9% of the global hash rate.

According to data from Coinwarz, computing power dropped from a peak of 194 EH/s on January 4 to 168 EH/s during the internet outage in Kazakhstan. Internet blocking is probably the reason behind the decline in global computing power online.

The waning computing power may not have led to an immediate drop in prices, but it may have contributed to the negative sentiment in the market.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Bitcoin price rises after new jobs data from US

European stock markets open higher | beursduivel.be

Russia’s oil imports to China decline