Yesterday the bitcoin price flirted with $40K, but the value has now fallen to just over $36,000. what is going on?

The British shocked the market

The specter of inflation gripped all markets. Even bitcoin, which has been bombarded by inflation hedge enthusiasts, is not immune. The a path It has decreased by 8.5%. The Bank of England has mentioned They expect 10% inflation before the end of the year. This led to a panic in the markets and the British pound fell by 2% against the US dollar. Compared to the euro, the pound fell 1.24%.

Bond markets were also affected by the news. Reuters Reports The two-year yield on government bonds fell 13 basis points to 1.41%. This is the lowest level of the month for the bonds.

Cryptocurrency is not immune

to me coinmarketcap The combined value of all cryptocurrencies decreased by 7.5%. Most likely, this is not only the fault of the pessimistic reports of the Bank of England, but also a mistake interest rate hike It was announced the day before yesterday by its American counterpart. There was a moment of jubilation because the rate hike was less than expected, but the jubilation has now been replaced by howling.

interest rises

The Bank of England decided to raise interest rates by 25 basis points, from 0.75% to 1%. This is the fourth increase since December, taking interest rates to the highest level since 2009.

The chart below shows the Bank of England’s interest rate hike. The decline in response to the onset of the pandemic is clearly visible, as is the rise in interest rates.

Set expectations

Andrew Bailey, Governor of the Bank of England She said It is unlikely that the UK will enter a recession yet, but the economy could face a significant slowdown, raising the risk of a recession.

The Bank has a type of Monetary Policy Research Office called the Monetary Policy Committee (MPC). In an earlier analysis, they shared expectations that inflation would be 8% by the end of the year, but it has now been revised to 10%. In addition, the expected unemployment rate in 2024 will be revised upwards from 3.6% to 5%.

Russia, Ukraine and China

In the Declaration From the central bank we can read that the British economy has taken a lot of hits. Several reasons are listed, but one seems to be missing. That is, financial journalism was in an unlimited position during Corona.

The economy has recently been hit by a series of very large shocks. The Russian invasion of Ukraine is such a shock. In particular, if the recent movements continue, as the central forecast assumes, the extremely high prices of global energy and tradable goods, of which the UK is a net importer, will necessarily have a greater impact on the real income of most UK households. UK households and corporate profit margins”.

The bank also refers to China. They say the novel coronavirus outbreak is causing supply chain delays.

What about a money printer?

There are many factors that prevent central bank monetary policy from working. but for special words Isn’t this the central bank’s fault:

This is something monetary policy cannot prevent. The role of monetary policy is to ensure that this real economic adjustment takes place, in a manner consistent with achieving the 2% inflation target over the medium term, while minimizing undesirable fluctuations in output. “

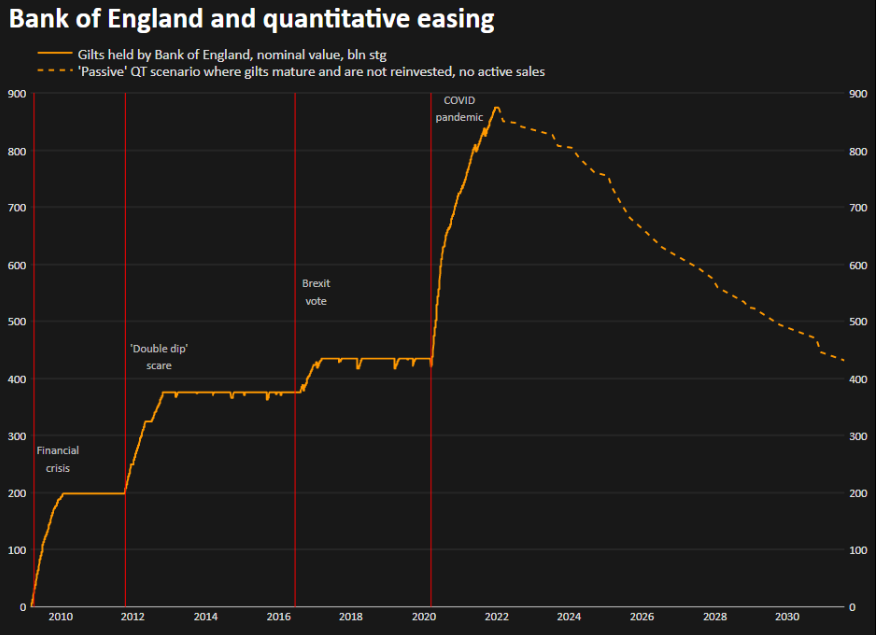

The chart below shows how the Bank of England deals with quantitative easing, they flooded the market with lots and lots of cheap (say, almost free) money. But as central banks tend to do, the reason is not sought here.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Bitcoin price rises after new jobs data from US

European stock markets open higher | beursduivel.be

Russia’s oil imports to China decline