Bitcoin (BTC) has been skyrocketing for a few weeks, likely due to optimism about the potential arrival of a spot Bitcoin ETF, or stock market fund, in the US. The racing calmed down last week and we have to look forward.

The truth is that we are still waiting for the final approval and launch of the Bitcoin ETF. In the meantime, interesting things are currently happening from a macroeconomic perspective:

Overall, there are more and more signs pointing to a recession in the United States, not to mention the Eurozone. What can we expect next week and what does this mean for the price of Bitcoin?

🎁 This week: Trade your first €10,000 of cryptocurrencies absolutely free

A week full of important dates for Bitcoin

We are facing a new week full of important macroeconomic developments, each of which could have an impact on the financial markets and potentially Bitcoin.

First, we will receive the minutes of the US central bank’s last interest rate meeting on Tuesday, or the so-called FOMC minutes. These minutes have the potential to cause price fluctuations.

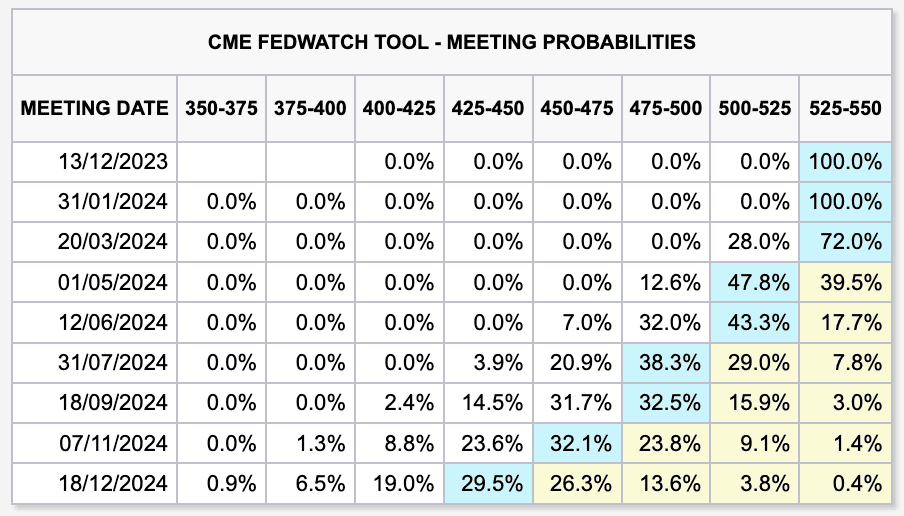

The chart above shows what the market is currently thinking about the US central bank’s future interest rate policy. The minutes of the latest interest rate meeting could seriously change this map.

For now, at least, the market believes the US central bank will meet in 2024 Four interest rate cuts Come.

The market also seems to be taking the recession into account, because with the current inflation data it seems like a stretch to cut interest rates four times. However, there are also analysts who say that inflation is falling rapidly and that interest rates must be lowered quickly to prevent deflation.

Then we move to Wednesday where we again get the number of US unemployment claims (weekly increase in unemployment). The forecast is 226,000 units, while last week it was 231,000.

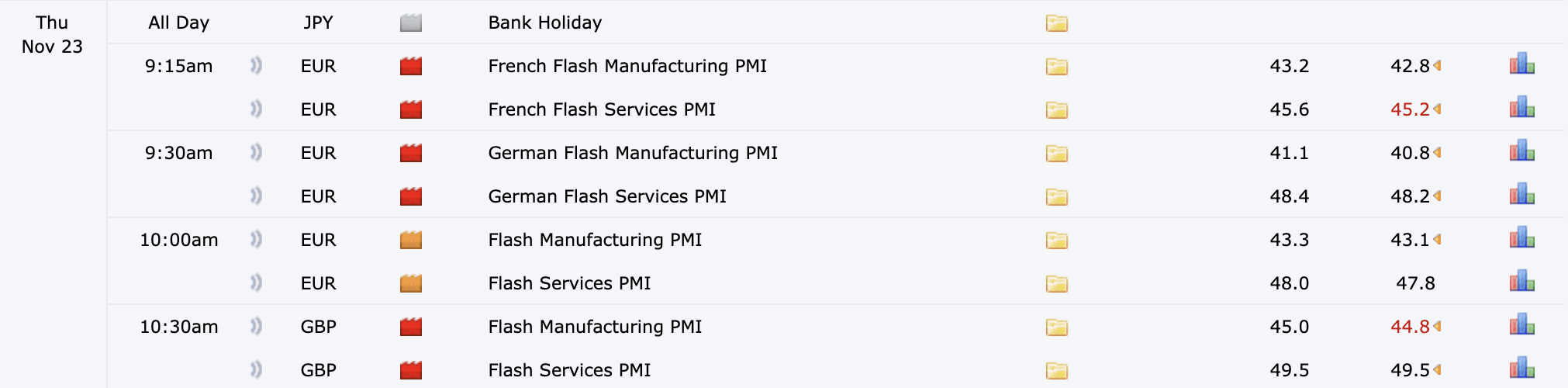

Then on Thursday it’s time for a batch of important economic data for the Eurozone and Great Britain:

Purchasing managers’ indices (PMIs) are important indicators for the manufacturing and services sectors. If these indicators fall below 50.0, this is usually a sign that the economy is contracting. In this regard, it seems that the Eurozone is not in a strong position at the moment.

On Friday, we close the week with the same data for the US, which is still just above 50.0 according to expectations and therefore safe.

What does this mean for the price of Bitcoin?

It seems that we have reached a critical point for the price of Bitcoin. Will the upward trend seen in recent weeks continue or will we come under severe pressure from an increasingly weak economy?

We are in unpredictable waters in the short term, but in the long term Bitcoin’s prospects are better. Interest rate cuts are back, the next halving is approaching, and the chance of approval for a spot US Bitcoin ETF appears greater than ever.

Need help with encryption?

In our premium environment you’ll find a friendly community of analysts and traders of all levels. Here you can talk to experts and newbies about the latest market trends and get first hand in-depth analysis.

We also organize weekly live streams and webinars for traders who want to delve deeper into technical analysis. We would like to invite you to start a 30-day trial in our premium environment for just €1.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Bitcoin price rises after new jobs data from US

European stock markets open higher | beursduivel.be

Russia’s oil imports to China decline