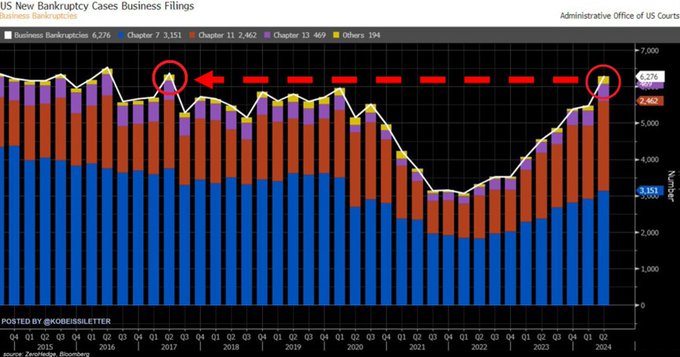

It’s raining bankruptcies in the US, but Bitcoin (BTC) doesn’t care. In the second quarter of 2024, 6,276 companies filed for bankruptcy in the US, the highest level since the second quarter of 2017. What does this mean? Should we still be worried about the US economy?

Soft or hard landing?

It’s an issue that investors and economists have been grappling with for months. Inflation is clearly at the desired 2.0%, but what will the economy do once that target is reached?

Will the US Fed’s aggressive interest rate hikes bring us yet another recession or will everything be okay? At least there are more data points towards a slightly cooling economy, as evidenced by the number of bankruptcies in the second quarter of 2024.

In two years, the number of bankruptcies has almost doubled, but it is worth looking closely at this graph. As you can see, the number of bankruptcies is currently at the same level as before the COVID-19 pandemic.

The number of bankruptcies has increased sharply, but bankruptcies may be postponed due to the COVID-19 pandemic. During that pandemic, the US government distributed a lot of support and tax credits were deferred.

In that sense, based on these data, it appears that no human has crossed the line.

What does this mean for Bitcoin?

For Bitcoin, the continued stability of the US economy is crucial. Based on the data, intervention by the US central bank (Federal Reserve) now seems critical.

More and more data points come at levels that are not entirely consistent with a solid economy. But that makes sense, because interest rates are relatively high and that naturally puts pressure on the economy, causing it to cool.

Now the war against inflation is almost over and interest rates may soon be cut again, allowing the Federal Reserve to achieve its desired soft landing.

This still seems like the most likely scenario at the moment, and it should, in theory, be good for Bitcoin’s price. Either way, a recession could be devastating for the digital currency’s bull market.

Something new every day in the crypto world! Stay informed 7 days a week Follow us on Instagram.

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

Cooperation between the US and China ensures more stable corporate finance – FM.nl

New US peace proposal for Gaza war ‘may be too smart for either side to say no’

China and US strengthen financial cooperation amid geopolitical tensions