Globally, there is growing concern about the “historic gamble” that the new . represents British Prime Minister Liz Truss Takes with the UK economy. The British are firmly opting for a downward-flowing economy on their new course. But what is this? Dutch economist and journalist Mathijs Baumann describes it in Nieuwsuur. “The rich get riches and the poor get poverty.”

Looking at. Who is Liz Truss, the new British Prime Minister?

British Prime Minister Liz Truss announced a two-year freeze on energy prices. With this move, you want to prevent more households and businesses from getting into trouble due to the sharp rise in prices. In this way stagnation must also be prevented or its extent limited.

The measure will cost the UK about 60 billion pounds, or 68 billion euros, over the next six months. This cost estimate is uncertain due to highly volatile prices. At the same time, taxes are reduced to boost the economy.

purchasing power

Dutch economist Matijs Baumann explains in Nieuwsuur on NOS what the package of measures means in practice. “The rich are getting richer and the poor are getting poorer,” Bowman says. They eliminated the highest tax rate, income tax is lower and property taxes are lowered. If you look at purchasing power, the richest Britons earn around £10,000 (£11,300) and the poorest Britons earn around £22 (£25).”

Rewards for bankers

In addition, it was announced that the restrictions on bonuses for bankers would be removed. UK bankers are now allowed to receive a bonus of up to twice the normal annual salary. This restriction was imposed by the European Union in the wake of the 2008 financial crisis. British Chancellor of the Exchequer Kwasi Quarting argued that he only increased base salaries and moved banks’ activities out of Europe.

The economics of “going down”

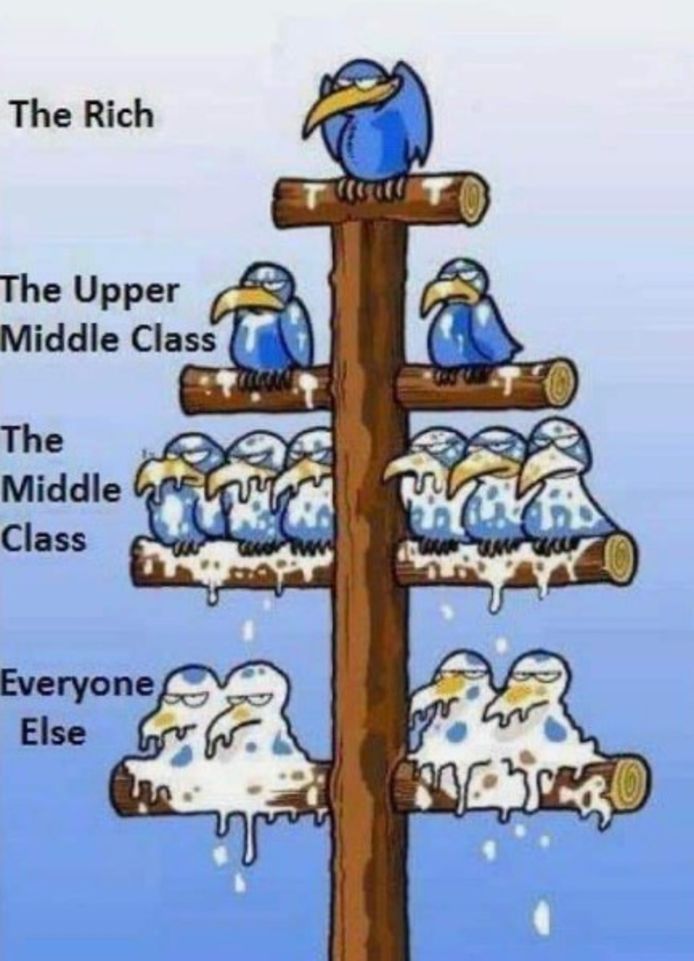

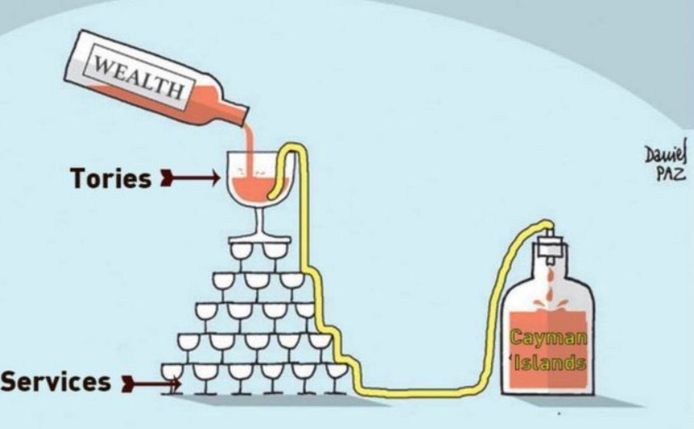

The new economic path is described as a choppy economy. Explained simply, the idea behind this is that if rich people have a lot of money, they take it and start their own business. The poor could go to work there, so that over time wealth would flow to the poor. As if you were filling the upper glass in the pyramid with glass, and then you will also fill the lower glasses at the end.

Historical guess

The problem with downstream economics is that many economists are convinced that it is futile. The fact that the financial market does not believe in it is also a notable fact in recent days. The pound fell to Monday low record against the US dollar. At the same time, yields on British government bonds rose. These are all signs that the market is concerned about British fiscal policy.

The British press is talking about a “historic gamble”. US President Joe Biden also expressed concern about turmoil in financial marketsBut he says the British have to set their own policies. But Biden appears not to be a fan of the “downstream” economy, and that’s clear from the tweet below from over a year ago.

Singapore on the Thames

According to economist Matijs Baumann, the new cycle is not without risk for Europe either. “This is what we feared about Brexit,” he explains in NewsSour. “That the UK would behave like Singapore on the Thames, with low taxes. Sort of a piracy country on the edge of Europe.”

British Prime Minister Truss himself also referred to Singapore. It has promised to “launch” London as a financial center to better compete with business centers such as New York, Singapore and Hong Kong. By raising the bonus cap, British capital should become more attractive to top bankers and stock traders.

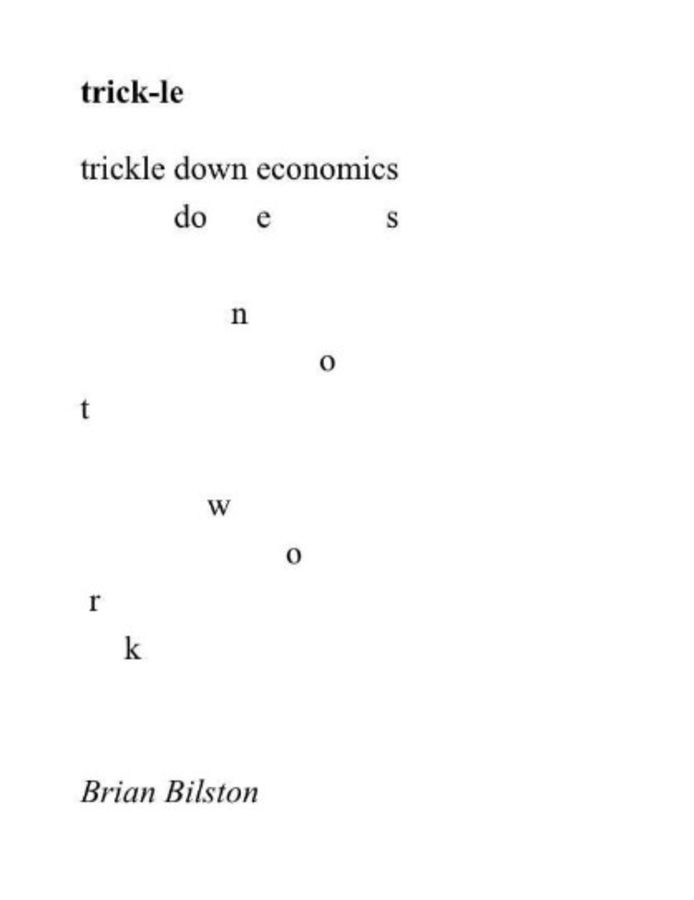

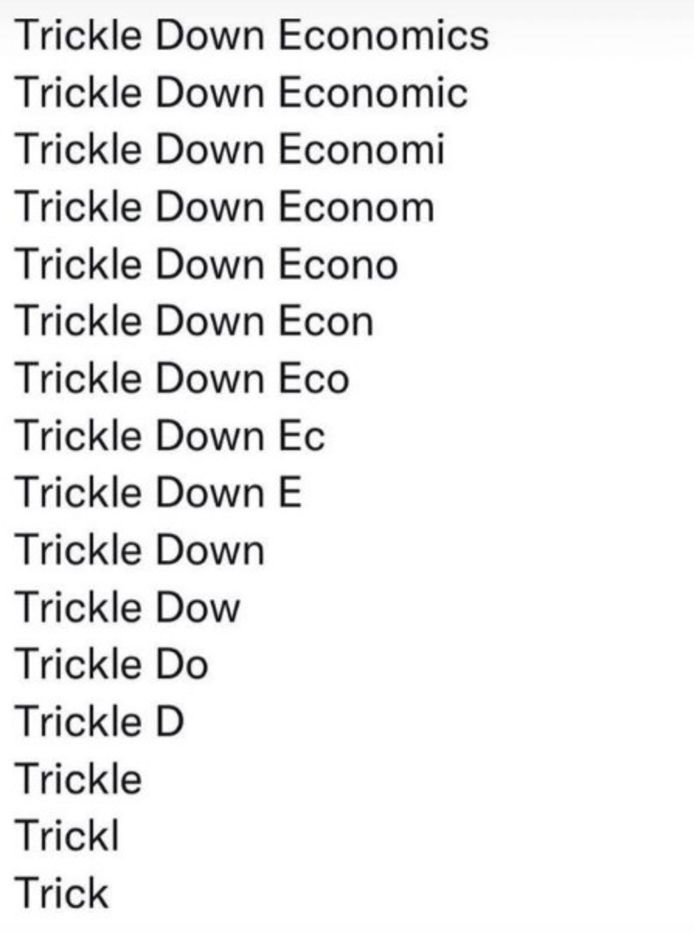

Numerous memes and images mocking the gushing economy have been circulating on social media since the New Economic Situation was announced. some examples:

Read also:

Unlimited free access to Showbytes? And that can!

Log in or create an account and never miss any of the stars.

“Creator. Award-winning problem solver. Music evangelist. Incurable introvert.”

More Stories

British military spy satellite launched – Business AM

Alarming decline in the Caspian Sea

Lithuania begins construction of military base for German forces