Amid global economic and political unrest, America’s image as an economic superpower is tarnished. That could damage confidence in Washington.

In the message: US credit rating agency Fitch Ratings has downgraded the rating of the US. So the long-term rating of US government debt is downgraded from “High Quality” (AAA) to “Above Average” (AA+).

- This downward revision is related to the “expected fiscal deterioration over the next three years”, weak governance and overall debt burden.

Reminder: Fitch rating An assessment of a country’s fiscal solvency. It refers to the ability to borrow money and hence the ability to repay loans. Investors take this into account when deciding whether to buy government bonds. So a downgrade in the US would affect those purchases.

- A number of factors are taken into consideration when rating a country: growth in debt, growth in repayment rates, repayment capacity, structure of debt and financial stability.

Trust is shattered

Description: The country has been on negative watch since May due to Washington’s difficulties in reaching an agreement on the debt ceiling.

- “Frequent political conflicts over the debt ceiling and At the last minute “The solutions have undermined confidence in the management of the budget,” Fitch said.

- The consequences of this decision were not long in coming. US stock futures started lower. Dow Jones futures fell about 100 points, reports said CNBC.

“According to Fitch, there has been a steady decline in governance standards over the past 20 years, including budget and debt levels, despite an agreement in June to suspend the debt ceiling until January 2025.”

Fitch Ratings

- The rise in general government deficits also played a role in Fitch’s decision to downgrade the US. The agency expects the deficit to widen to 6.3 percent of GDP this year from 3.7 percent in 2022.

- Fitch justifies its decision by the continuing risk of a moderate slowdown in the US economy in the fourth quarter of 2023 and the first quarter of 2024 – despite good results in the second quarter. Credit tightening, weakening business investment and slowing consumption.

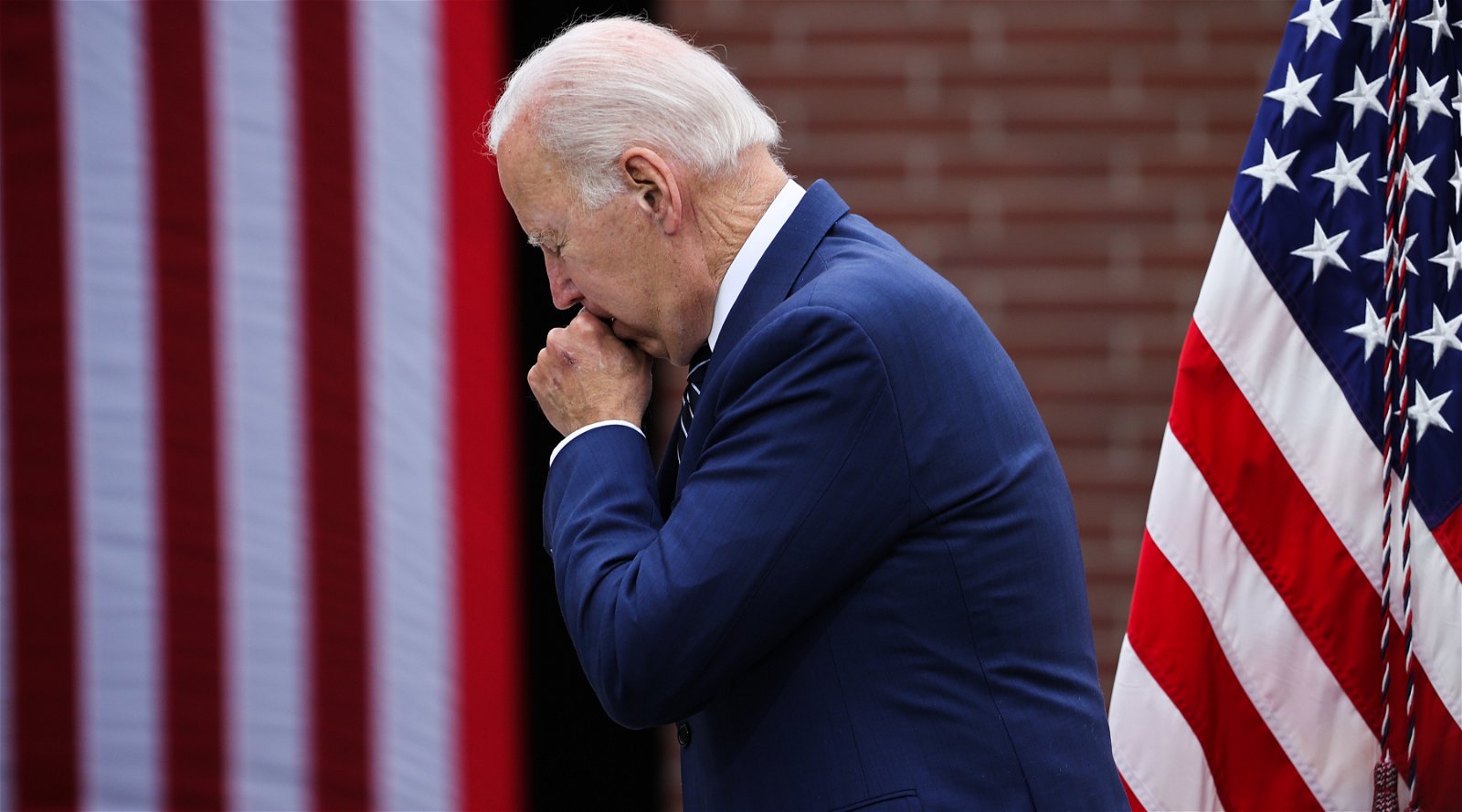

Strong reactions from the Biden administration

Fitch’s decision has prompted a strong reaction from the US government. The White House has expressed displeasure with the review, which it finds unsubstantiated and contrary to common sense.

- “It’s unrealistic for President Biden to downgrade the United States at a time when any major economy in the world has had the strongest recovery,” press secretary Karine Jean-Pierre said.

- Administration officials tried to reassure everyone by insisting that US financial management practices were sound. According to reports, they also tried to prevent the assessment agency from announcing the result Bloomberg.

- According to them, the main reason for this demotion was actually the events of January 6, 2021 and the storming of the Capitol by supporters of Donald Trump. Fitch has repeatedly raised concerns about the impact of the attack, several officials said.

Worth mentioning: As the US presidential campaign takes shape ahead of the 2024 election, the decision to downgrade America has been made.

- Republicans and Democrats alike will no doubt use it to criticize the actions of the opposing party.

- But mainly Biden and his economic policies will suffer.

What impact does this have on Americans?

The Biden administration has tried to assuage concerns about the potential fallout from the Fitch decision. He promises that this will have a minimal impact on America’s real borrowing costs.

- “Fitch’s decision doesn’t change what Americans, investors and people around the world already know: our Treasuries are still the world’s most important safe and liquid asset, and the U.S. economy is fundamentally strong,” Treasury Secretary Janet Yellen said. (grey)

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

Cooperation between the US and China ensures more stable corporate finance – FM.nl

New US peace proposal for Gaza war ‘may be too smart for either side to say no’

Bitcoin weathers bankruptcy storm in US