Central banks around the world have begun lowering interest rates over the past six months, after raising interest rates significantly in 2022 due to massive inflation.

Over the past six months, we have seen a total of 55 interest rate cuts around the world. It is unfortunate that the two central banks that are most important to us: the US Central Bank and the European Central Bank have not yet begun their work.

What does this development mean for the global economy and the price of Bitcoin?

Central banks around the world have begun rapidly lowering interest rates

It's only a matter of time before the Fed joins the party pic.twitter.com/aPY1riazuO

– Game of Trades (@GameofTrades_) March 28, 2024

🚀 Dutch Stock Exchange Celebrates the Next Bull Market: Everyone Gets Free Cryptocurrency Worth €20

The weather changes completely

It is clear that central banks are slowly coming to the conclusion that they have won their battle against inflation. Each of them chooses to lower interest rates. Now we basically have to wait for the US central bank, which has chosen to suspend interest rates for several months, but is still making us wait for the first interest rate cuts.

SOS Call to all economists #recession ?! What is this bullshit? Latest global shipping activities….and now policy makers want to ease?? pic.twitter.com/CUaLsXu1cO

— Crossborder Capital (@crossbordercap) March 28, 2024

The big question now, of course, is whether this is the right time to cut interest rates. For example, we see that activity among shippers is increasing significantly, which is not usually a signal for a rate cut.

Against the backdrop of the high inflation we are still seeing, it is best to expect this to be a signal of a new increase in interest rates or at least a longer pause.

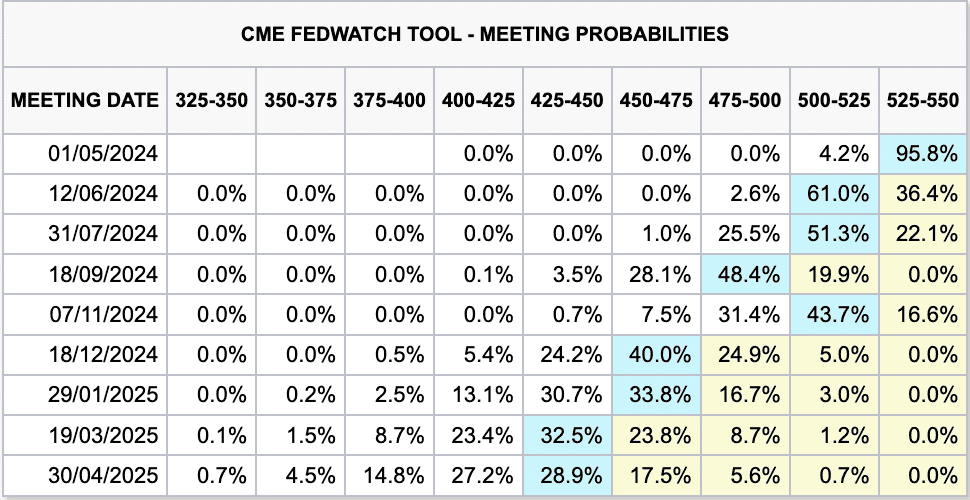

The market currently appears to be betting on June as the first moment the US central bank will choose to cut interest rates. However, compared to yesterday, the chance of interest rates stopping again has increased from 29.9% to 36.4%.

The market seems increasingly forced to acknowledge that the US central bank will also choose to keep interest rates where they are in June.

What does this mean for the price of Bitcoin?

This means that the price of Bitcoin will not receive any help from a macroeconomic angle for a while. However, it would also be bad news if the US central bank were suddenly in a rush to cut interest rates.

Right now there is no reason to cut interest rates and inflation remains very high. If there is such a rush, it means the economy is under pressure and this is not good for the Bitcoin price.

In this regard, we can hope that interest rate cuts will not take a while and spot Bitcoin ETFs will continue to do their job against Bitcoin.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Bitcoin price rises after new jobs data from US

European stock markets open higher | beursduivel.be

Russia’s oil imports to China decline