The US Federal Reserve (Federal Reserve) today decided to keep interest rates unchanged from 5.25 to 5.50 percent. This would end the most aggressive interest rate campaign in history and is the rate that must be achieved to reduce inflation to the desired 2.0 percent.

Below we will discuss the US Federal Reserve’s policy choice in more detail, and of course its impact on the price of Bitcoin.

Evidence

According to the Federal Reserve, there is still no reason to cut interest rates and 12 central bank policymakers still expect an interest rate hike, while 7 policymakers still do not expect an interest rate hike.

According to the Federal Reserve, inflation will end at 2.6 percent in 2024. Unfortunately, interest rates are expected to remain at this high level for a relatively long period of time, further reducing inflation.

Of course unless we get a recession, that won’t be good news for Bitcoin either.

What does this mean for the price of Bitcoin?

Bitcoin’s initial reaction has not been positive, and this appears to be a result of the Federal Reserve’s announcement that interest rates will remain at this high level for a relatively long period of time; At least it seems so at the moment.

Ultimately, the impact of Federal Reserve policy on bitcoin prices will depend on how long it takes for inflation to return to the desired 2.0 percent. Given the current rate of inflation, this may take a relatively long time.

The US consumer price index was 3.0 percent, but has now rebounded to 3.7 percent. Mainly as a result of rising oil prices.

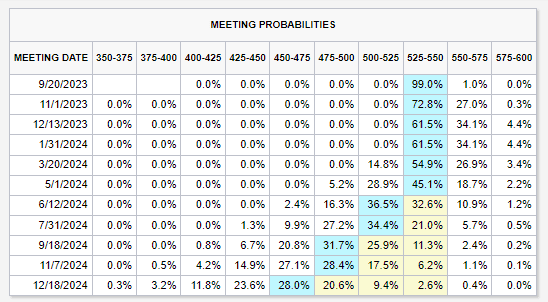

Although interest rates are currently relatively high, the market currently sees a roughly 40 percent chance of a new interest rate hike in 2023 (see the December 13 meeting in the chart above).

Before December 13, according to the market, there is a 34.1 per cent chance of 5.50 – 5.75 per cent interest and a 4.4 per cent chance of 5.75 – 6.00 per cent.

In that sense, the US Federal Reserve may raise interest rates again as a result of inflation getting out of hand.

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

Cooperation between the US and China ensures more stable corporate finance – FM.nl

New US peace proposal for Gaza war ‘may be too smart for either side to say no’

Bitcoin weathers bankruptcy storm in US