Listen to the audio version of this article below

- Economic clouds are gathering for investors with US interest rates, slower economic growth and the possibility of a tightening of central banks.

- However, the US stock markets in particular have been remarkably bullish.

- Stock market experts Michael Nabaro and Kogan Erem discuss the extraordinary dynamics that dominate the financial markets.

- read more: Insurers are recovering quickly in the stock market: look at Akon stock

Analysis – These are special times in the financial markets, especially in the United States. Fast climbing Swelling And Rising interest rates There seems to be no question in the stock markets for a while that it started to move upwards from the low of March 7th.

Investors do not pay much attention to the problems in the global supply chain, and little attention is paid to the ripple effects of Western sanctions against Russia, other than the emergence of a humanitarian catastrophe in Ukraine.

These named factors will lower stock prices in any normal period. But this does not apply to US stocks in recent days and weeks.

The S&P 500 Index And the Nasdaq 100 has been marching briskly on the assumption that it is controlled by the Federal Reserve. Long-term interest rates are now on the decline in economic growth. But if it gets too bad, central banks may push the print button again, and stock investors think so.

Or are other things playing out?

At other times: Globalization under pressure, no free money

The timing of the current rally is very spicy due to Central Bank Chairman Jerome Powell Market ready Excessive tariff hike in May.

Several members of the Federal Reserve Policy Committee have already called for a 0.5 percentage point interest rate hike, which could raise the Federal Reserve’s key interest rate to 2.5 to 3 percent by the end of this year.

The bond and currency markets responded as expected (with higher yields and a stronger dollar), but US stocks did not.

This is very special because when looking at the macro background it is very challenging to find a good reason to support stocks in the current conditions, let alone setting new records.

This is how The Economic globalization Under extreme pressure. The organization relies heavily on the interconnectedness of national economies for the transnational movement of goods, services, technology and capital. In recent years, however, protectionism and self-confidence have emerged, transforming free trade agreements and promoting economic globalization.

What started a little Trade wars and rising import taxes Has become a complete hindrance to complex multinational supply chains. The lesion is severely exposed after corona infection.

The problems are currently exacerbated as the war in Ukraine threatens food and energy security. Not to mention other possible geopolitical uncertainties. Consider, for example, the role of China.

Companies are now in the process of diversifying supplier locations, increasing inventory and Bringing the product closer to the final market To increase supply security.

Instead of the cheapest and easiest production method, the safest and most secure will be selected. In addition, in terms of cash, the period of free money is coming to an end. Financing businesses and consumers will again become more expensive.

You would argue that all of this should result in lower stock ratings and higher risk premiums.

U.S. stocks are resilient

Where does the strength of the US stock market come from? Part of the answer: TINA (There is no alternativeMost alternatives to investing in stocks are unattractive.

Real interest rates – where you adjust market interest rates for inflation – are very negative. In addition, not everyone buys bonds during a cash crisis: The price of securities falls as interest rates rise.

So the following applies: Even if interest rates rise and are adjusted to suit inflation, these are currently loss-making proposals.

With the risk of a recession in the event of a recession, the central bank will intervene in the opposite direction to the devaluation of the currency, despite high inflation, as investors in the United States argue: stocks again.

Some major American technology giants boast strong cash flow, with the ability to pass on any increase in their spending to customers, becoming an effective hedge against inflation.

The US S&P 500 Index seems to benefit from this, giving greater weight to mega-multinational companies like this. For example, we see that most of the recent rise in this index has been caused by Microsoft, Alphabet, Apple and Amazon, while Tesla has recovered.

Energy companies and funds are also performing well, but the overweight of the aforementioned giants in the S&P 500 is currently a determining factor.

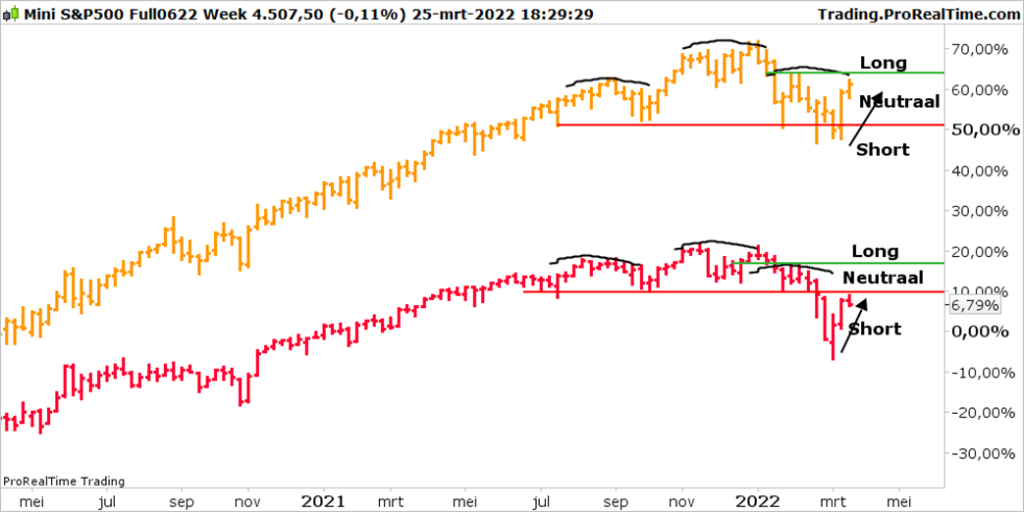

Because of this strong renaissance Big guys The S&P 500 is approaching a critical juncture. In addition, an improvement will provide even more confidence. The failure of a turning point can lead to profitability and put pressure on the stock markets again.

Head-shoulder pattern: Inverted or continuous

Before we look at the S&P 500 chart conclusively, let us provide a brief theoretical explanation. The head and shoulder pattern is one of the most reliable inverted shapes in technical analysis. It has three distinct peaks, of which the middle one (head H) is higher than the other peaks (shoulders S).

Once the line connecting the base of the first two peaks (neckline) is broken, the pattern is complete.

Usually, after this break, Price will do a short test of the recently broken neckline and then dive deeper. This is called pulling. Only then does the price target equal to the distance from the head to the neckline. (Left example)

The following is important: If the drag fails and the neckline is sent upwards, there is a false signal and the pattern loses its value. This neutralizes the sales signal.

However, now it is coming. After a failed retreat, if the right shoulder is removed upwards, the reverse shape becomes a continuous shape. (Perfect example)

Now practical.

The orange line is the S&P 500 index. It has entered a neutral level after a strong rise this week. If buyers are able to break the level of 4,600 points, there is also a chance for a new record.

The red chart is about the EuroStoxx index, which still meets the conditions for an immediate collapse! The recovery in Europe is not strong enough to return to the neutral region. Either the damage was too high or the power was too low. The opposite is true Funds are flowing in the United States.

So where is the difference now? The strength of the US dollar and especially the weight of major US technology companies.

Michael NabaroChartered Marketing Technician (CMT), Kogan Erem, CMT, Independent Investment Specialists, both with over 25 years of experience in the financial sector. With thorough knowledge and extensive experience, they serve professional and private investors based on their methodically validated, active investment method.

This column contains the authors’ comments and findings. The financial values mentioned in this letter may be part of the authors’ investments and their relationships.

This column is not advisory in any form and is considered non-personalized information about financial markets.

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

Cooperation between the US and China ensures more stable corporate finance – FM.nl

New US peace proposal for Gaza war ‘may be too smart for either side to say no’

Bitcoin weathers bankruptcy storm in US