Mark Van Hool, co-founder and partner at investment fund CIM Capital, was unwittingly in the spotlight last month. The family member, who was bought out in 2001, saw his bid to buy a section of the bankrupt Van Hoole vehicle group rejected. “I certainly don't want to sound like a frustrated loser. But I have a feeling there's something else at play here.”

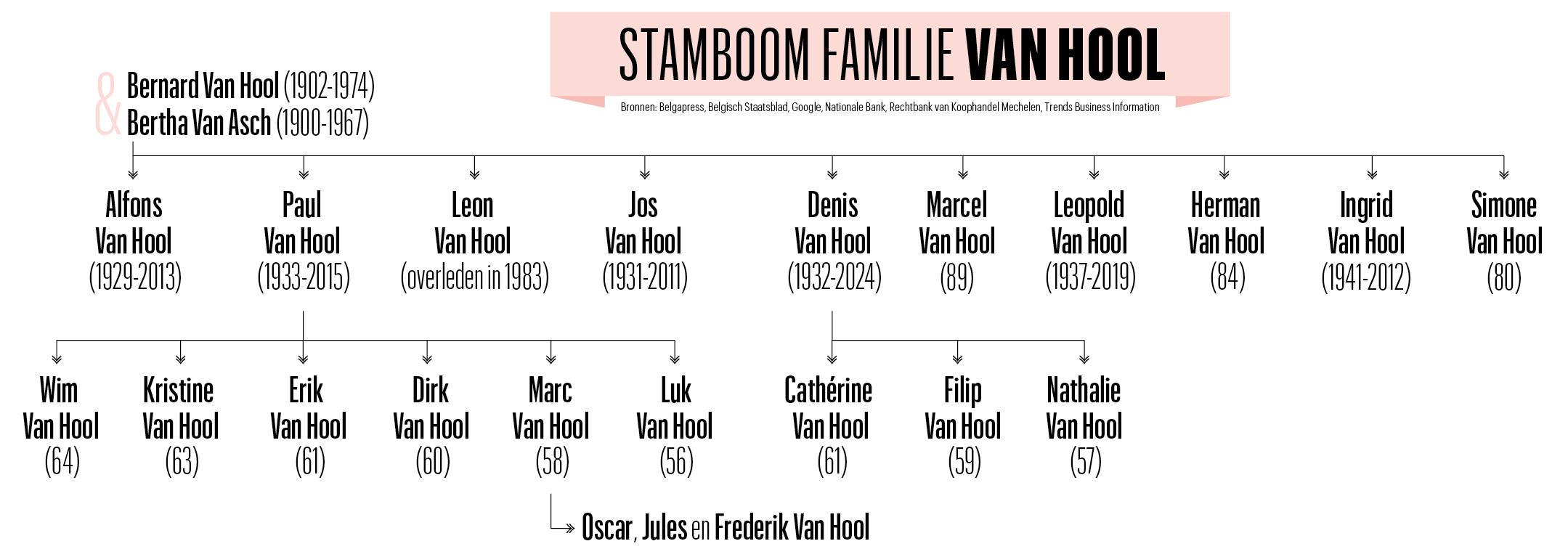

Mark is the cousin of Philipp van Hool, co-CEO of car manufacturer Koningshooikt until bankruptcy. But the family branch of Mark Van Hool and his father Paul left the family business in 2001.

He is now a partner in the investment fund CIM Capital. He tells his story on the fifth floor of offices in Antwerp, with a view of MAS. It is the afternoon of Tuesday, April 16, and the April air is making the wind howl, and the rain pounding on the windows. CIM Capital has gained a good reputation over the past decade. Mark Van Hool was nicknamed the “business doctor,” because the investment firm buys companies in trouble and gets them back on track. The most popular investments are the retail chains Veritas (sewing and knitting supplies) and Neckermann (travel agencies). And both are doing better than initially budgeted. His son, Oscar Van Hool, is a partner at CIM Ventures, which deals with small companies in difficulty.

How does bankruptcy feel as a family member?

Mark Van Hall. “It makes me sad. It's a shame that the heritage and the great brand are gone. I worked there from 1991 to 2001. After my studies I worked at General Bank. In the financial engineering cell I worked on mergers, acquisitions and IPOs. In 1991, my father Paul asked me, The bus and coach sales manager, and my uncle Alphonse, the CEO of Van Hool, suddenly they made an acquisition, LAG Bus in Barre, and this acquisition was difficult to digest and given my background in the bank, I had to get a number of things right I thought It's too early, but if the family asks you to, you have to take that step. I worked there until 2001. Eventually I was the CFO, which is what today is called the CFO. I left when my family branch was bought out by the other five branches, which They remained shareholders.

Read more under the family tree

What did you take with you from those years into your later career?

Van Hall. “I grew up in an entrepreneurial family that always worked hard. You have to do that if you want to be successful. But I also saw the downside. You have to surround yourself with capable partners and employees if you want to succeed.

People outside the family?

Van Hall. “Especially this one. And you have to anticipate changes. This is often more difficult in family businesses. They stick to a pattern and a methodology for a very long time. 'We've always done it this way, so why shouldn't we keep it that way?'” Family businesses often change too late. It's time.

Why did your family branch sell its shares?

Van Hall. “There was a major disagreement about corporate governance. We wanted operational management by individuals outside the family. In addition, we had a different view on the economic strategy of the business. Even then, there was a need to shift production to low-wage countries. It eventually happened under CEO Philip Van Hool but perhaps it was a bit too late” (In 2013, Van Hool opened a branch in North Macedonia, ed.).

Anticipating changes is often more difficult in family businesses

Suddenly I made a bid for the industrial vehicles division with CIM Capital.

Van Hall. “This division has an efficient factory in Koningshooikt. In recent years, it has been continuously investing in automation, for example, welding robots and laser cutting machines. This factory shows that the manufacturing industry in Belgium still has a future. If you invest in the right way and organize it in the right way True, manufacturing is possible in Belgium. There is of course a barrier to wage costs, but Belgium also has a lot of professional knowledge and technical expertise.

However, it was the German-South African group JRW Schmitz Kargopol that took the spoils. Does CIM Capital lack the right scale for industrial activity?

Van Hall. “We only wanted to buy this division, not Van Hool as a whole. The industrial vehicles division was profitable enough. 2023 was a record year. As an investment fund, we could also have improved things. Crisis manager and co-CEO Mark Zwaneveld told us this at the beginning In March, to us, a restart seemed possible only through bankruptcy, given the high debt burden.

If you invest in the right way and organize it in the right way, the manufacturing industry is possible in Belgium. There is of course a drag in the cost of wages. But Belgium also has a lot of professional knowledge and technical expertise

Was your title an obstacle in negotiations?

Van Hall. “I don’t know, and I hope not. CIM Capital is a professional investment company. But we did not have access to the necessary financial information. Without analyzing the books we could not make an offer.”

Why didn't you get that information?

Van Hall. “This still worries me somewhat. We were always told that we had to bid on the whole thing, otherwise we wouldn't qualify. I thought that was strange logic. I think VDL Groep and GRW Schmitz Cargobull are each bidding separately. It was reported in the media The media said they were linked but that was not the case, so separate bids were already possible from our side as well.

I hope my family name wasn't at the expense of our show

Do you want to take legal action?

Van Hall. “Our law firm Agio noticed many anomalies in handling and blatant violation of the new legislation. So yes, we are thinking about it. But at the same time we look at the interests of the company. The plant should not remain idle for a long time. I do not know if the company GRW Schmitz Cargobull will restart the company as quickly and comprehensively as we wanted. We simply wanted the division to continue as an independent company with the existing facilities, people and machines, and we wanted to keep the majority of them because that division was doing well.

GRW Schmitz Cargobull wants to retain 350 people.

Van Hall. “There will be fewer. There is talk of 115 to 120 people. But I certainly don't want to seem like a disappointed loser. We often participate in bidding. Whoever bids more has no problem with that. But I have a feeling that something else was at play here, and as a result We couldn't provide anything.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Bitcoin price rises after new jobs data from US

European stock markets open higher | beursduivel.be

Russia’s oil imports to China decline