US President Joe Biden recently issued an executive order Signed Central Bank for the development of digital money, a digital dollar. Various government agencies and the US Federal Reserve are going to map out how this currency can be put into circulation. But what is digital central bank money? What does this mean for the financial system and the way we pay?

Central Bank Digital money is a new form of money issued by the central bank, similar to coins and banknotes. It is a centralized monetary system in which the central bank monitors all transactions and has full control over them. This is fundamentally different from our current monetary system in which different commercial banks perform these functions together.

According to the IMF, more than 100 countries are already researching or implementing digital central bank money. China is already experimenting with its digital yuan, while India plans to introduce a digital currency in the future. The eurozone and Russia work on the digital currency. Significantly, the United States lags behind other major economies in this new development. That is why the US government is now putting more pressure on the growth of the digital dollar.

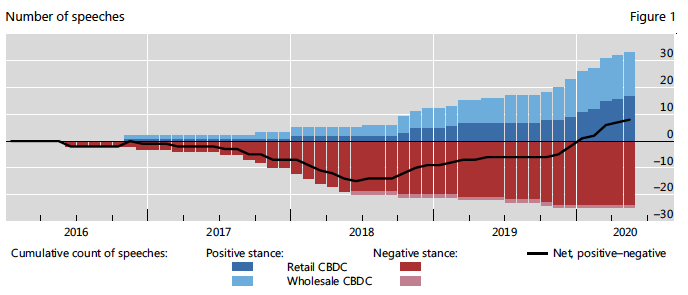

Central banks speak more and more positively about CBDCs (Source: BIS)

Why Digital Central Bank Money?

Payment methods have changed drastically over the last ten years. As the role of large technology companies such as Google and Apple in daily payments increases, so does the use of money. The popularity of cryptocurrencies is also increasing as an alternative electronic payment method. As a result of these changes, central banks have less control over payments and monetary systems.

They are trying to regain power with digital central bank money. It is suitable for the digital age, as an alternative to money. No longer, consumers can deposit their money directly in the central bank, so there is less reliance on commercial banks. If so, the Deposit Guarantee Scheme is no longer required. It sounds like an improvement, but is it a good development?

More control

Characteristic of Digital Central Bank Money All transactions and assets are placed at a focal point. Central banks will have more insight into the payment method, so they will have to accept the greater responsibilities that commercial banks now have. For example, think about Get to know your customer (KYC) policy, which aims to combat money laundering and crime. With digital central bank money, central banks can determine who gets access and who does not. This is not possible with crypto or cash payments.

Digital central bank money seems to be a solution to finding a problem. It competes with the current infrastructure of commercial banks and, due to its centrality, implements greater financial repression. Or are those financial stability benefits? That is the question.

read more:

This article has been published before Other newspaper

Related:

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

Cooperation between the US and China ensures more stable corporate finance – FM.nl

New US peace proposal for Gaza war ‘may be too smart for either side to say no’

Bitcoin weathers bankruptcy storm in US