Despite the corona waves, 2021 looks set to land in the history books as a strong year for the stock market. This is exactly what KBC analysts wrote in last year’s review.

The year may not be over yet, but many investors at Christmas are already wondering what the returns will be this year.

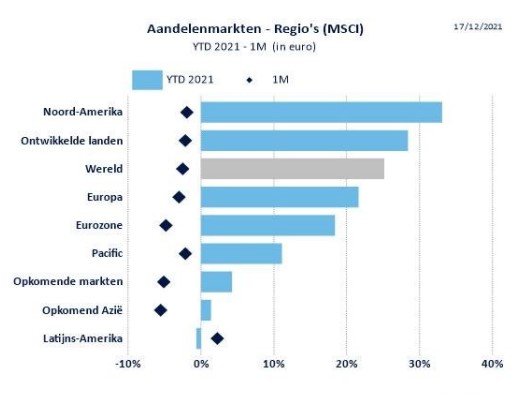

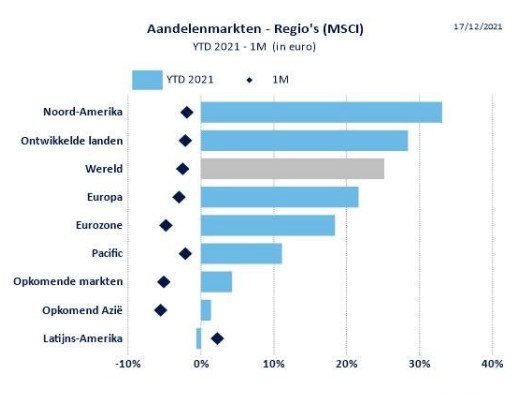

Global stock markets opened in euros this week, according to KBC experts About 24 percent more Will be in early January. Sure, you may not know these capricious corona times, but the value of stocks at the end of this year will be on average a quarter higher than they were at the beginning of this year.

This global trend obscures key regional differences.

- With temporary average price losses of about 15 percent on the table, Chinese stock markets look even harder to block the red stock market year. Much related to the poor financial condition of real estate companies Evergrande.

- The Turkish stock market is also not under the market due to incomprehensible monetary policy President Erdogan Pushed by.

- Europe made a good start, with the KBC looking back, but trailing by the third quarter.

“America First”

Which area was the big drawer? In the United States, according to statistics, the average price gain is more than 30 percent. It is noteworthy that corporate profits exceeded expectations throughout the year and economic growth strengthened again in the fourth quarter. “The strong dollar helped boost returns on U.S. stocks by an additional 8 percent,” the KBC analysis said.

What President Donald Trump said a year ago that Joe Biden’s new president would cause stock markets to collapse has not materialized.

Analysts and economists are also on strike for 2022 Confidence in the US economy, The corona crisis does not throw much space into work.

(bzg)

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

Cooperation between the US and China ensures more stable corporate finance – FM.nl

New US peace proposal for Gaza war ‘may be too smart for either side to say no’

Bitcoin weathers bankruptcy storm in US