The municipality of Eklo has been in the news recently because it still has to collect €6.5 million in outstanding bills from businesses and citizens. But when does the bill expire and no longer have to be paid?

A financial audit conducted by the Municipality of Iklo revealed that 1,200 businesses and citizens had not paid their bills and invoices in recent years. This concerns more than 15,000 claims for a total amount of €6.5 million. Amounts range from a few euros – such as fines at a library – to tens of thousands of euros.

All parties were notified, but because the debt has been increasing for more than ten years, the municipality will lose more than 300 thousand euros. “Bills due usually expire after ten years, and after that you can’t collect them,” said the city council’s finance alderman. But is this true?

Edited expiration

An unpaid bill or debt cannot actually be claimed forever. The legislator has introduced a “prescription editing” system. This means that customers will be relieved of their payment obligations over time.

The purpose of the statute of limitations is to protect the debtor from late reactions from creditors. But it should also prevent the debt from becoming excessively burdensome with recurring payments (such as renting a house), and may be supplemented by compensation and interest for late payments. The liberalized limitation period should also encourage traders to remain alert and intervene timely in the event of any payment problems.

Expired vs. Expired Invoice

An expired invoice is sometimes confused with an overdue invoice. However, there is a fundamental difference. “An overdue invoice is an outstanding debt for which the payment deadline has been exceeded,” says Jeroen De Man of law firm De Groote – De Man. “If the trader has not concluded specific agreements about this with the client in the B2B context, the due date defaults to thirty days after the invoice date.”

“The expiration date of an invoice is a completely different thing. This means that the customer is released from his obligation to pay. The creditor no longer has the legal right to pay the outstanding invoice. In short: in principle, the expired invoice is no longer collectible.

What does that mean concretely?

Let’s say you received the bill for the washing machine that was delivered to your home last year. Or you receive a reminder of an internet bill you forgot to pay a few months ago. Or you will receive the bill for the Corona test that will be performed in the hospital in 2021. To what extent can you be forced to pay back those “old debts”?

“There are some general limitation periods,” explains Jeroen De Man of the law firm De Groote – De Man. “The general principle is that personal legal claims lapse after ten years. All real claims – such as disputes over ownership rights or the right to usufruct property – expire after thirty years.”

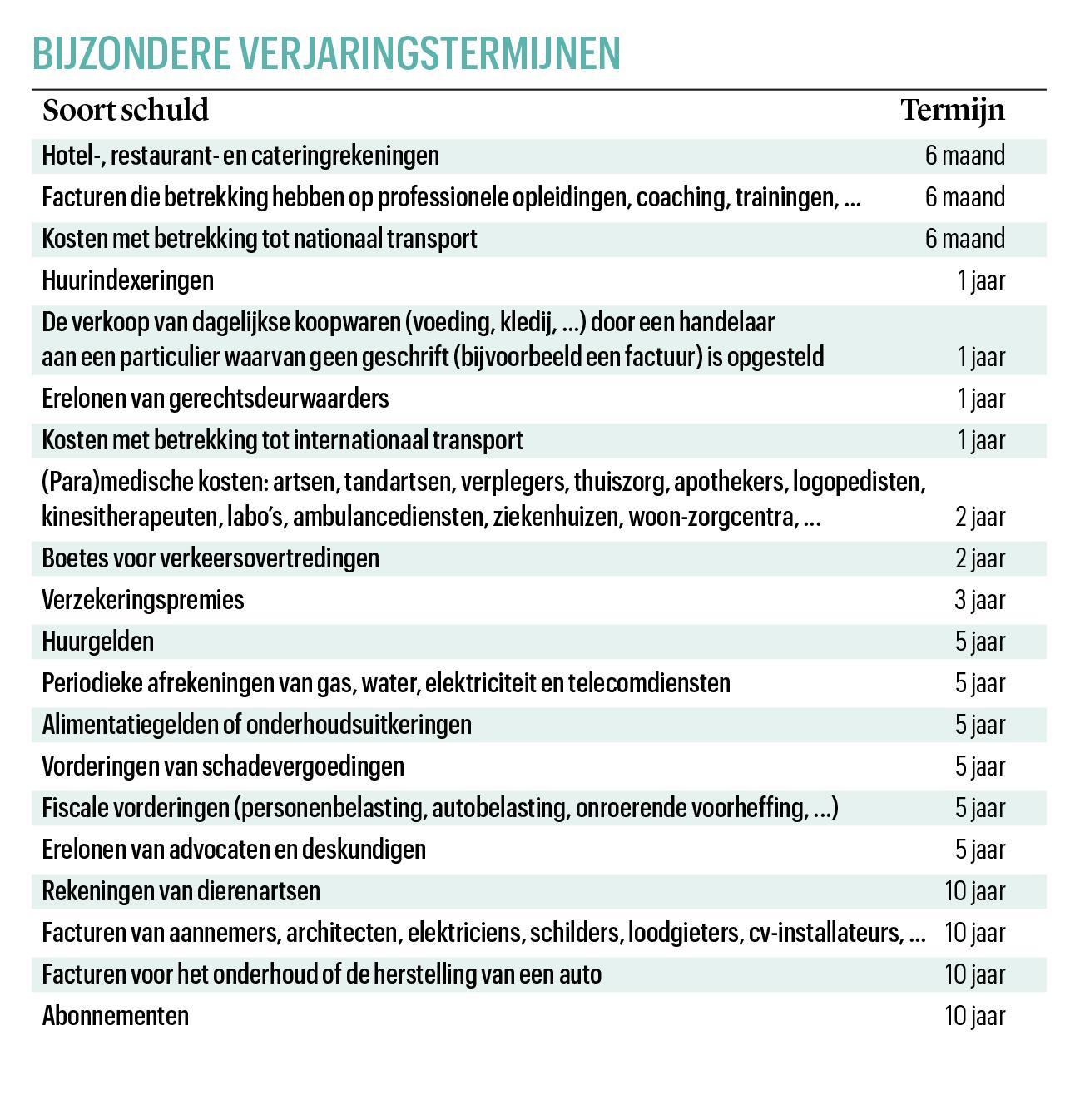

In addition to the general conditions, the legislator also applies a number of special limitation periods that are shorter depending on the type of debt.

“As a private customer, you can demand a one-year limitation period for the sale of goods for which a written document has not been prepared,” explains Jeroen de Man. “Once you set up an invoice that is due in one year, that one-year period ends.” In practice, this is the case, for example, when buying a car or a boiler.

In principle, the limitation period starts from the due date of the invoice. But this is not always the case. For personal tax, for example, the five-year period begins from the end of the second month following the sending of the tax notice. For a health care bill, the two-year period begins in the month following the month in which the care was provided.

Interruption of the statute of limitations

When the seller or contractor sends a registered letter reminding you that you still have to pay, the statute of limitations continues. However, some actions may interrupt or suspend the limitation period.

Do you as a customer continue to ignore reminders and does this jeopardize the limitation period? In this case, the merchant can proceed with judicial collection. Setting such an action ensures that the bill is “stopped”. In the event of such an interruption, the current limitation period ends and a new limitation period begins.

“Even if you, as a debtor, admit that you owe something, you are cutting off the limitation period,” warns Jeroen de Man. “This is the case, for example, when you send an email requesting payment.”

In addition to interruption, the limitation period can also be suspended. This means that the current chapter has been interrupted or paused for a certain period, but has not ended. This happens, for example, when the seller initiates a collection procedure. There are many other reasons to comment, but they are less important in this context.

Do you need to enforce your rights?

If the invoice arrives after the statute of limitations, in principle you as a consumer do not have to do anything. The limitation period occurs automatically. So it is up to the trader to bring this up for discussion. If he does not agree to this, he may ask the judge to rule on this matter. This may take some time, but until then the statute of limitations runs.

However, consumers can go to the website of the federal government service Sample letter Downloading, through which they can enforce their rights. Jeroen de Man: “This can be useful if you, as a customer, want to provide clarity to the supplier about your situation, with the aim of stopping any reminders.”

Also good to know: Once the debt term expires, you will no longer need to provide proof of payment.

Finally, also know that if you pay off a time-stuck debt, you will no longer be able to get the amount paid back. It is therefore important to check in advance the applicable limitation period.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Bitcoin price rises after new jobs data from US

European stock markets open higher | beursduivel.be

Russia’s oil imports to China decline