There is currently a theory in the macroeconomic world that the US Federal Reserve will not cut interest rates until 2024.

The idea behind the theory is that the US economy is very strong and has continued to grow for the time being, while contributing to the US Federal Reserve's “transition” (to the point of pausing and thinking about lowering interest rates). The strength of the US economy.

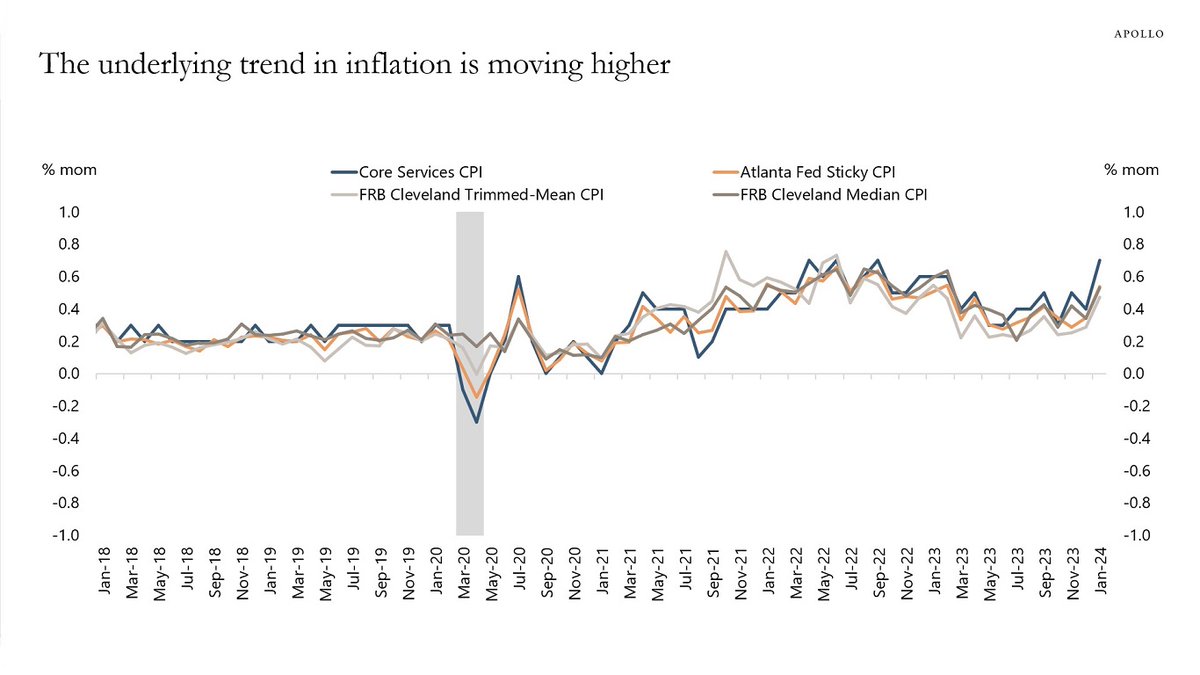

As a result, inflation has started a new upward trend. What If No Interest Rate Cuts Affect Bitcoin Price?

🚀 Dutch exchange celebrates upcoming bull market: €20 free crypto for everyone

A big problem for the US government?

On Twitter, noted macroeconomist Luke Groman even speculated that US interest rates are at 6 percent. That means we'll get even more interest rate hikes instead of cuts.

On $35 billion in debt, it will eventually pay $2.1 trillion a year in interest.

If people think inflation and nominal GDP growth are strong now, see what happens if the Fed raises to 6%, a 6% yield curve on $35T of debt over time, ultimately resulting in $2.1T (8% of GDP) per year. Interest “stimims” (4-5% of GDP+ non-interest deficits.)🚀 https://t.co/Mi30QUhPrG

— Luke Gromen (@LukeGromen) March 1, 2024

According to Gromen, that would be 8 percent of US gross domestic product (GDP). That misery accounts for more than 4 to 5 percent of the budget deficit the U.S. government produces annually.

In other words, the US government's budget deficits seem to be growing.

Why this bitcoin price boom?

It is possible Positive For the price of bitcoin, because the US government has no choice but to turn the money printer back on.

The economy was not growing fast enough to sustain the debt. Add to that higher interest rates and things will get very difficult for the US government. This is at the expense of the US dollar's purchasing power and this benefits Bitcoin.

This dynamic has investors looking for scarcity like Bitcoin. People are beginning to understand that mounting debts are the only realistic outcome of this financial system, forcing the government to hide what it cannot print.

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

Cooperation between the US and China ensures more stable corporate finance – FM.nl

New US peace proposal for Gaza war ‘may be too smart for either side to say no’

Bitcoin weathers bankruptcy storm in US