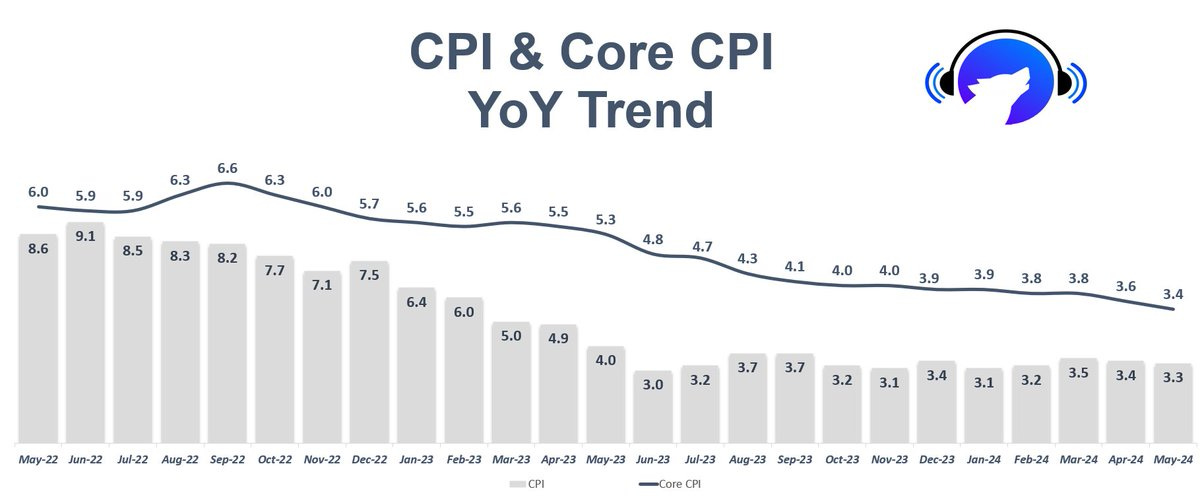

Bitcoin price rose on Wednesday after positive inflation data (less than CBI expected). Bitcoin rose to $70,000, but the resistance there was too high. Subsequently, the market was also hit hard by the Federal Reserve.

“We’re looking for something that gives us more confidence that inflation is coming down,” Chairman Jerome Powell said during his press conference.

Notably, the futures market has already managed to detect that optimism. They currently see a more than 70% chance of the first interest rate cut in September. Unfortunately, the central bank is still not convinced of that.

A free financial newsletter?

Does macroeconomics sound interesting to you?

Then subscribe for free to my newsletter De Geldpers.

Roomy 2,500 people He went before you!

each one Monday And Thursday I send new versions completely free of charge.

Trust is the key word

“Confidence” seems to be the key word for the US Federal Reserve at the moment. Jerome Powell used the word about 20 times during his press conference. Their current reluctance to make positive statements on inflation is surely a result of the 2023 – Q1 2024 shock.

In December 2023, the US Federal Reserve declared victory over all inflation. That was a big mistake, because after that the financial markets went up and Americans started consuming like crazy again.

The result? Inflation picks up in first months of 2024

For now, Powell and his allies still want to track inflation Look a little moreBefore they promised us interest rate cuts. This doesn’t change the fact that this week’s data was very positive for Bitcoin. That is strange enough not to see a positive price reaction.

🚀 Dutch exchange celebrates bull market: everyone gets free crypto of their choice

Aren’t you worried about the effects of higher interest rates on the price of Bitcoin?

A strong US economy is the main reason the Federal Reserve is struggling so much to reduce inflation. Unlike in the past, the US is less dependent on bank loans, meaning that tight monetary policy has little impact on the economy.

Many people have fixed their mortgage rates for a long time, meaning they are still paying lower interest rates. As a result, relatively less money goes into mortgages and more money is consumed, which of course causes inflation.

However, there seems to be a positive trend happening right now, which should bode well for Bitcoin and the rest of the risk asset market. In that sense, it is surprising that Bitcoin is currently lagging behind and struggling to reach higher prices.

We’ve seen Bitcoin underperform relative to traditional stock market indices in recent months, which isn’t a good sign for the market in general.

In that sense, it is hoped that future traders’ expectations will be met and the Federal Reserve may start cutting interest rates in September. In any case, hopes for this have increased significantly over the past week, and now the price of Bitcoin is still…

Don’t want to miss important crypto messages anymore? Then follow our brand new WhatsApp channel. Here we keep you updated with the most important crypto news 7 days a week.

“Passionate analyst. Thinker. Devoted twitter evangelist. Wannabe music specialist.”

More Stories

Cooperation between the US and China ensures more stable corporate finance – FM.nl

New US peace proposal for Gaza war ‘may be too smart for either side to say no’

Bitcoin weathers bankruptcy storm in US