Bitcoin (BTC) price has started 2024 on a high note, under the inspiring leadership of Bitcoin exchange-traded funds. After a false start, Bitcoin price has risen to nearly $52,000, as the digital currency appears to be facing resistance. This resistance may lie in a few macroeconomic developments currently weighing on the market.

Economic developments affect the price of Bitcoin?

For example, last week it was announced that US inflation is higher than initially thought. The Consumer Price Index came in at 3.1%, while it was expected to reach 2.9%.

This reduces expectations for interest rate cuts from the US central bank in 2024. This is negative for the price of Bitcoin, because risky assets benefit from lower interest rates.

As interest rates fall, capital becomes cheaper, more new capital is put into circulation, and eventually some of it ends up in Bitcoin. Fortunately, spot Bitcoin ETFs are performing admirably.

For example, BlackRock is on track to surpass MicroStrategy in terms of Bitcoin quantity. So far, the world's largest asset manager has managed to withdraw 109,609 Bitcoin from the market. MicroStrategy has 190,000 to buy as of August 2020.

It seems like it's only a matter of time before BlackRock and Fidelity at least catch up to Michael Saylor's MicroStrategy. This development now appears to have a greater impact on Bitcoin's price than the negative macroeconomic data mentioned above.

Next Thursday will be crucial for the Bitcoin price

Thursday promises to be a real macroeconomic holiday. The whole Thursday is filled with important dates for the Eurozone and the United States.

Among other things, we receive information about the health of the industry and services sector in both areas. In addition, we obtain weekly unemployment claims for the United States.

The latter is important because the strong labor market has so far succeeded in protecting the US economy from recession.

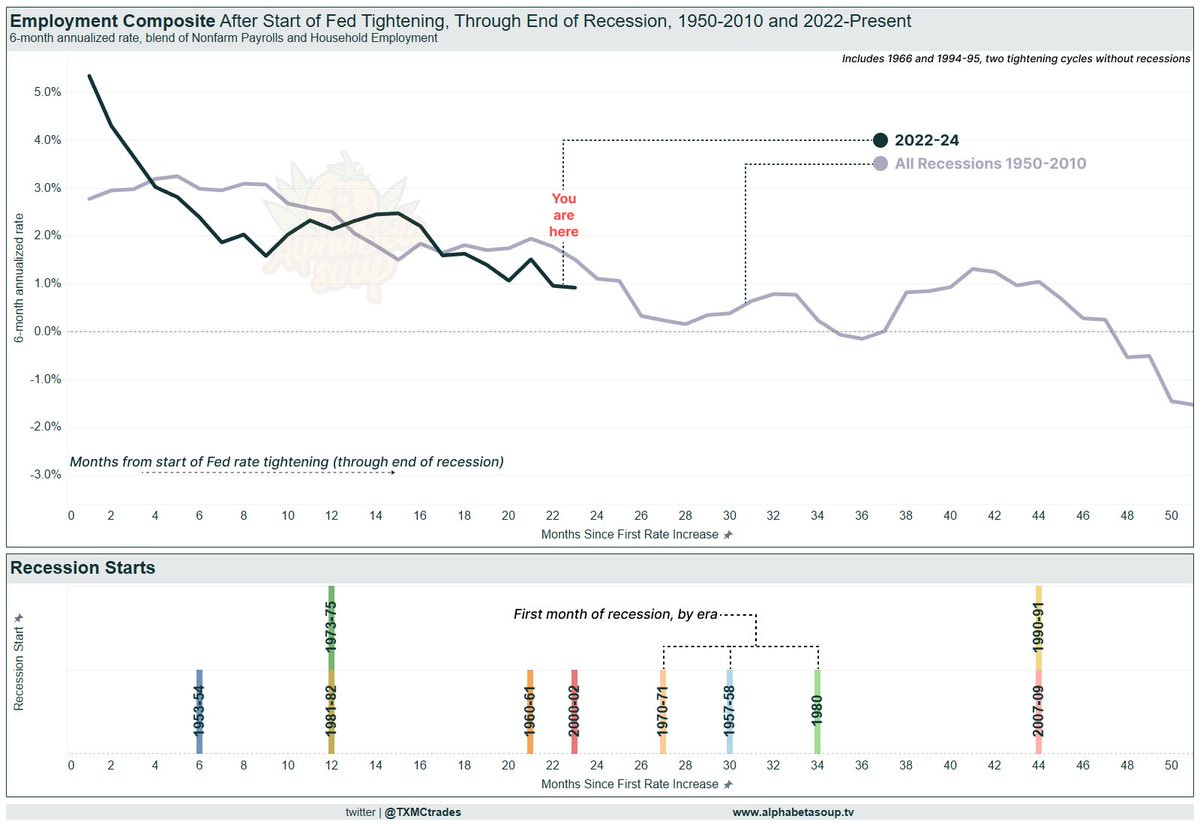

However, if we look at the chart above, we see that the US labor market has been weakening since the first rate cut in March 2022 at the same rate as the recession years from 1950 to 2010.

So it is still too early to say that a recession will no longer happen, and partly for this reason, next Thursday could be crucial for the price of Bitcoin.

need help?

In the featured environment of Crypto Insiders, we are monitoring this development closely. Here we discuss important macroeconomic developments and the potential impact on Bitcoin price every day.

In our premium environment you'll find a friendly community of analysts and traders of all levels. Here you can talk to experts and newbies about the latest market trends and get first hand in-depth analysis.

We also organize weekly live streams and webinars for traders who want to learn more. We would like to invite you to start a 30-day trial in our premium environment for just €1.

Disclaimer: Investing involves risk. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and advice provided on this site is based on the insights and experiences of our analysts. Therefore these are for educational purposes only.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Bitcoin price rises after new jobs data from US

European stock markets open higher | beursduivel.be

Russia’s oil imports to China decline