At the time of writing, Bitcoin's price is around $69,000. it seems that Bulls It will have every difficulty keeping the price permanently above $69,000, the all-time high in 2021.

An important reason for this appears to lie in the current macroeconomic situation. In January and February, US inflation turned out to be higher than expected, prompting the US central bank to continue postponing the first interest rate cuts.

In theory, this development puts pressure on the market and that is why next Wednesday could be so crucial for the Bitcoin price.

🚀 Dutch Stock Exchange Celebrates Bull Market: Everyone Gets Free Cryptocurrencies of Their Choice

Why is next Wednesday crucial for the price of Bitcoin?

Interest rate cuts are beneficial for risk assets like Bitcoin, and in order to lower interest rates, the US central bank wants to see evidence that the high inflation numbers in January and February are a temporary phenomenon.

Next Wednesday we will release the US Consumer Price Index for March. These inflation numbers are perhaps the most important since the US central bank began raising interest rates in March 2022.

If inflation turns out to be higher than expected (and hoped) again, we may see not three, but two or even fewer interest rate cuts in 2024. In theory, that could be disastrous for markets, at least in the short term.

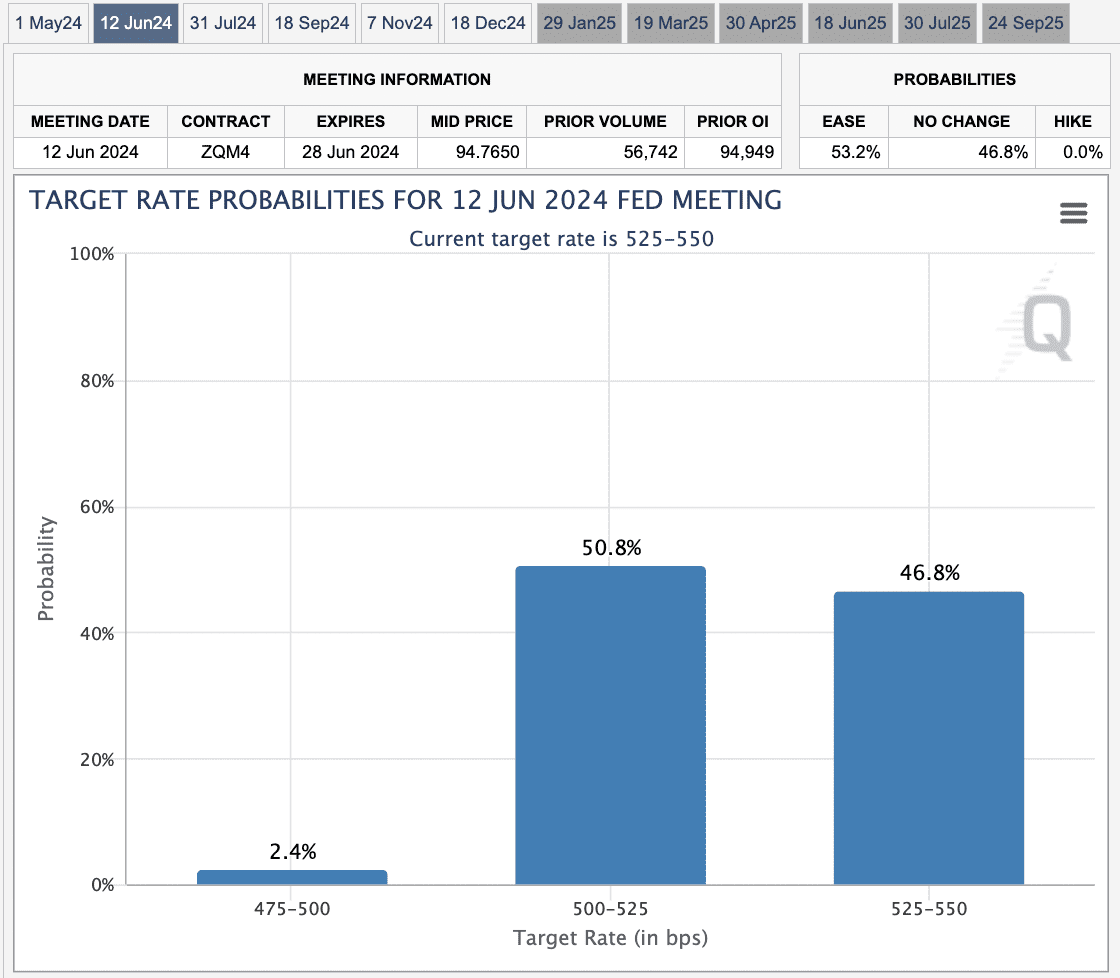

If inflation turns out to be lower than expected, that will be great news and we will likely get the first rate cut of this cycle in June.

Right now, according to the market, there is still a 53.2 percent chance of a first interest rate cut during the June 12, 2024 meeting. Next Wednesday's inflation numbers could shake these percentages significantly and cause a lot of volatility.

Is high inflation really catastrophic for Bitcoin?

In the slightly longer term, the question remains how disastrous it would be for Bitcoin's price if inflation spikes again next week. This means that the US central bank will keep interest rates at this high level for a longer period.

The “problem” with this is that the US government is struggling with huge debt, much of which it will have to refinance over the next 12 months. Trillions of dollars in debt will jump from the low interest rates of the past ten years to the relatively high interest rates the central bank currently uses.

If the US central bank does not lower interest rates, the US government's annual interest costs will rise significantly. This means that the annual budget deficit is increasing, debt is increasing, and interest coverage costs are rising again. In theory, this could lead to a negative debt spiral, which could become very difficult for the US dollar.

In other words, if interest rates remain at this high level for too long, the value of the US dollar could be detrimental. This allows investors to turn to alternatives that the government cannot print, such as bitcoin, gold, stocks, real estate, artwork, and other collectibles.

Looking for more depth into crypto?

In our Discord society We discuss important macroeconomic developments and their potential impact on the price of Bitcoin every day. Here you enter a safe space where traders of all levels exchange knowledge.

Ask your questions to expert analysts and top traders about trading, market trends and cryptocurrency topics in a vibrant community. We also organize weekly live streams and webinars for traders who want to delve deeper into technical analysis.

“Total coffee specialist. Hardcore reader. Incurable music scholar. Web guru. Freelance troublemaker. Problem solver. Travel trailblazer.”

More Stories

Bitcoin price rises after new jobs data from US

European stock markets open higher | beursduivel.be

Russia’s oil imports to China decline